Planning an Exit

The Urgency Continuum: Meeting Your Clients Where They Are

Feb 4, 2026

Almost every advisor has experienced it: A client who wakes up one day and realizes they’re ready to sell their business. They tell you they need to sell “today,” or worse yet, you have to tell them they have nothing to sell.

But as advisors, our job is to make sure that doesn’t happen. Knowing that most business owners kick the can down the road, how do we reframe exit planning to ensure this never happens?

Why Do Business Owners Avoid Exit Planning?

Business owners don’t avoid exit planning because they want to. It’s that it often feels untenable to manage their business and plan on exiting it at the same time. It’s almost as if, paradoxically, it is somehow at the top and bottom of their list.

Reason being, exit planning feels messy and fragmented for most business owners. Accordingly, an advisor's biggest challenge is removing friction from the process. To help you create alignment, drive momentum, and make each step of exit planning feel more manageable for business owners, it’s important to consider where your client falls on the urgency continuum.

What Is the Urgency Continuum?

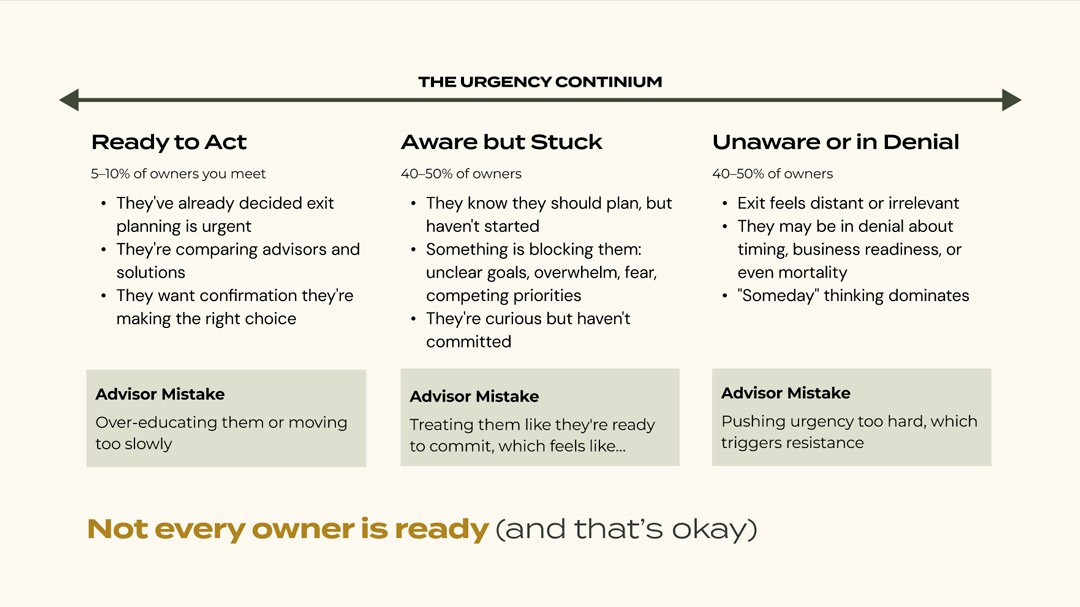

The Urgency Continuum is a spectrum of business owners’ exit readiness, ranging from those ready to act to those unaware that exit planning should be on their radar. While every business owner falls in a different spot on the Urgency Continuum, there are three core groups:

Ready To Act | Aware But Stuck | Unaware or In Denial |

|---|---|---|

≈ 10% of owners | ≈ 45% of owners | ≈ 45% of owners |

These owners:

Advisor Mistake: Over-educating them or moving too slowly | These owners:

Advisor Mistake: Treating them like they’re ready to commit | These owners:

Advisor Mistake: Pushing urgency too hard, which triggers resistance |

Every business owner should have the same end goals:

Maximize transferable business value

Prepare financially for a lifestyle without the income from the business

Plan personally for what they will do in their next act after exiting the business

But different stages on the Urgency Continuum call for different approaches and different conversations.

Where advisors tend to experience resistance is when they work with clients as if they’re all in the same place on the Urgency Continuum. Without identifying readiness, they risk inadvertently adding friction to the exit process. Ultimately, it’s about asking the right questions at the right time.

When advisors pinpoint where their clients are on the Urgency Continuum, they can meet them where they are. It lowers the pressure of the exit planning process. It stops feeling like an interrogation and more like a conversation. And, more often than not, business owners end up sharing more information this way, surfacing gaps, risks, and timing issues without being asked.

With all of that information out on the table, the exit planning process is jump-started.

Help Clients Discover Urgency

The goal is not to manufacture urgency. The goal is to meet owners where they are and move them forward one step at a time without triggering resistance or shutting down the conversation. At the end of the day, an advisor’s job is to deliver real value to our clients by helping them move toward an exit at a pace that aligns with their readiness.

When you put business owners in control, they feel more confident and make better decisions. After all, they’ve likely spent years, if not decades, building their legacy. Exiting their business in a process that feels rushed, not urgent, brings about a sense of loss of control.

It’s essential to keep in mind that legacy is also about responsibility. Owners worry about the people who depend on them: their team, their customers, and their family. They care about whether jobs remain, whether the culture survives, and whether the transition reflects their values, not just the price.

That's why trust matters so deeply. When an owner hires an adviser, they're not delegating a task. They're sharing the weight of their life's work and expecting it to be handled with care.

Owners don't resist because they're irrational. They resist because they're protecting something deeply personal. It’s their identity, their legacy, their life's work.

An educated owner is more likely to take action, but more information alone doesn't lead to action. In fact, it often does the opposite. No matter how well-intentioned the info is, every new detail adds another decision, another risk, another “what if.”

Information answers questions, but it doesn't remove hesitation. Most owners aren't stuck because they don't understand the math. They're stuck because the implications feel real now.

It’s the reason why the first deep dive into business financials doesn't spark momentum. It actually confirms the instinct to slow down.

Fear, uncertainty, and doubt (FUD) create paralysis. That's why 90-page deliverables don't always work. FUD jams the gears because it overloads the brain right when you're asking it to decide. Fear narrows focus and pushes owners into a self-protection mode. Uncertainty removes a clear next step. Doubt turns inward, making people question their own ability to act.

When all three show up together, a long deliverable doesn't feel helpful. It feels risky. Alas, the safest move becomes no move at all.

Conversely, movement happens when information is paired with clarity, shared context, and a next step that feels manageable rather than overwhelming. When owners see a small number of clear choices and understand what they’re personally accountable for, the threat level drops and momentum comes back.

When we create custom deliverables that actually fit the client, respect their bandwidth, and give them a clear path forward, we reduce friction. That's where urgency naturally starts to form, not because we pushed harder, but because the owner is finally ready to move.

Meeting Clients Where They Are

So the question is, how do we make ourselves and our clients successful at the same time? Clarity and ownership are what create urgency and commitment. Think of this as wayfinding. An advisor's role isn't to drag owners to a destination. It's to help them see the terrain clearly enough that they choose to move.

This is the precise reason ELLA starts with structured fact-finding: not to create more data, but to create specific, manageable steps that build momentum. When next steps and a clear definition of success are concrete, urgency follows naturally. ELLA makes success viable, visible, and shared. When advisors and business owners are aligned, urgency stops being emotional and becomes practical. If you’re interested in learning more about how our digital workbench for advisors works, reach out today to schedule a demo.